A short while back I was approached by the team at a Pharma company to help them launch and scale a brand new app.

The goal was to help solidify the branding and generate a couple of hundred beta testers for the new app.

Here’s what we managed to achieve…

- Built an internal marketing team

- Created the brand positioning and presence

- Generated over 7000 qualified beta testers within an ~8 week campaign

- Helped get the feedback and information needed for the next iteration of the app

I’ll run you through the process I used to achieve this.

Want to know exactly where your business is leaking revenue?

Answer a few quick questions and I'll send you a personalised growth report showing your biggest opportunity and exactly how to fix it.

Table of Contents

ToggleAbout the brand

Frustratingly, I’m not permitted to share the exact details of the brand nor the exact assets we created.

What I can do is explain the steps I usually use in my approach to growth and walk you through how they played out in this specific example.

What I can tell you about the brand is that it was a health tech offering which combined a wearable with an app specifically for weight loss.

The parent company was a mid-sized pharma company who wanted to launch a direct to consumer app.

Now, onto the process.

Step 1 – The overall goal and where we’re starting from

Whenever I start with a growth marketing strategy the first thing I do is look for the end goal and where we are right now.

This way, I get a good overview of what we want to achieve and an idea of what we might need to get there. I can start to reverse engineer potential stages and actions to help us get to the goal.

In this case, the end goal was to get at least 200 beta testers for the new app. The obvious goal of that was feedback and real-life usage of the system to see how people actually interacted with it.

At the point where I was brought on, the brand hadn’t yet done anything to create growth.

In fact, all they had was…

- An almost-ready app

- A basic one-page website

- An idea of the ideal audience

- A simple branding book which talked about brand colours and touched on ToV

We were basically starting from nothing so this was going to require a full new build of a growth model.

In some ways, this is great because you have a blank canvas to build whatever you want.

In other ways, it can be a real pain because you have to create traction and momentum from a standing start.

Thankfully, we didn’t do too badly at all.

Here’s how we did it.

Step 2 – Understanding the landscape

Before we could get creating, we needed to figure out what exactly might be needed. However, we had no target market to poll or any existing customers to interview.

We were flying blind.

I spoke to the founder and asked for information. First on who he saw as their ICP.

Next, I wanted information on who they saw as the biggest competitors in the space. The plan was to use the closest competitors to understand more about and refine…

- The ideal customer personae (ICP)

- The most effective marketing channels

- The differentiation options that were open to us

- The weaknesses in their approaches we could exploit

I ended up splitting the competition into 2 groups for research purposes.

The first focused on the outcome of the offer – weight loss.

The second were similar solutions sending data to an app – wearable devices.

I ended up with a list of around a dozen or so brands to check out. But the split would look something like the below.

| Result focused competition | Solution-focused competition |

|---|---|

| Noom | Levels Health |

| Weight Watchers | Veri |

Why split the focus?

Because I didn’t feel like either category was offering the complete solution the client was.

Noom had seen great success by focusing on the exact same outcome we were aiming for, I also had a great understanding of their system thanks to our detailed analysis project.

But they had no wearable and so trying to wedge similar messaging into a different product might be difficult.

Levels Health had great success with a wearable, but their focus was on a different outcome (something I’ll explain about in a short while).

I needed to somehow marry the two into something that would work well.

Knowing a little more about the landscape we were entering into, It was time to start the research.

Step 3 – Audience research

As the client hadn’t launched, we didn’t have access to existing customers to interview to see what they liked, disliked, were struggling with etc.

So, we had to rely on third-party research.

I usually use this as a supplement to 1st party research, but when you don’t have the access, it can give you a great starting point.

The process here is really simple. I would spend time going to places where the ideal customers would hang out and talk about their problems and also how they viewed the competitions offers

We’re talking…

- Social media shares

- Review sites like Trustpilot

- Online groups and communities

- Reviews on materials ideal customers would buy like relevant books on Amazon

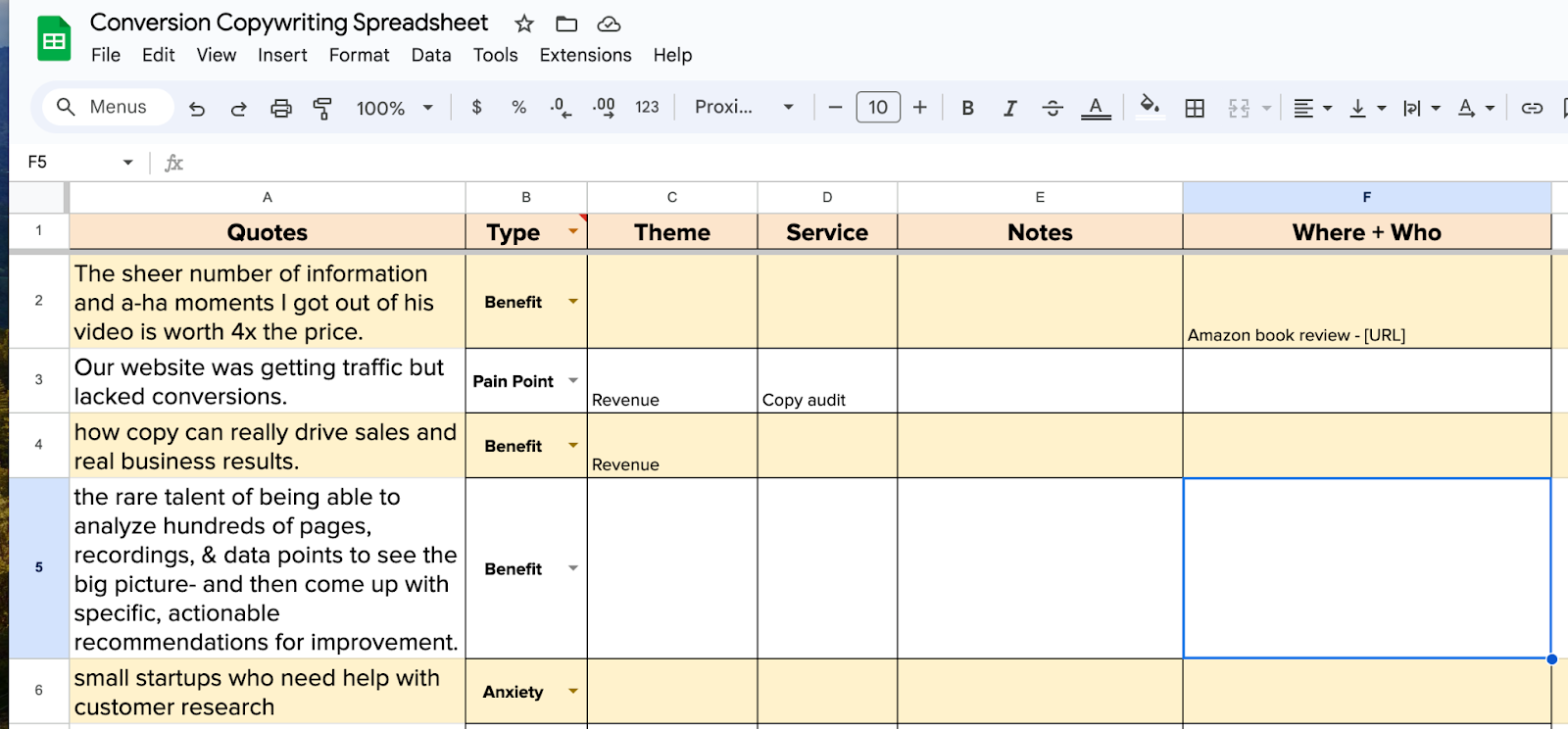

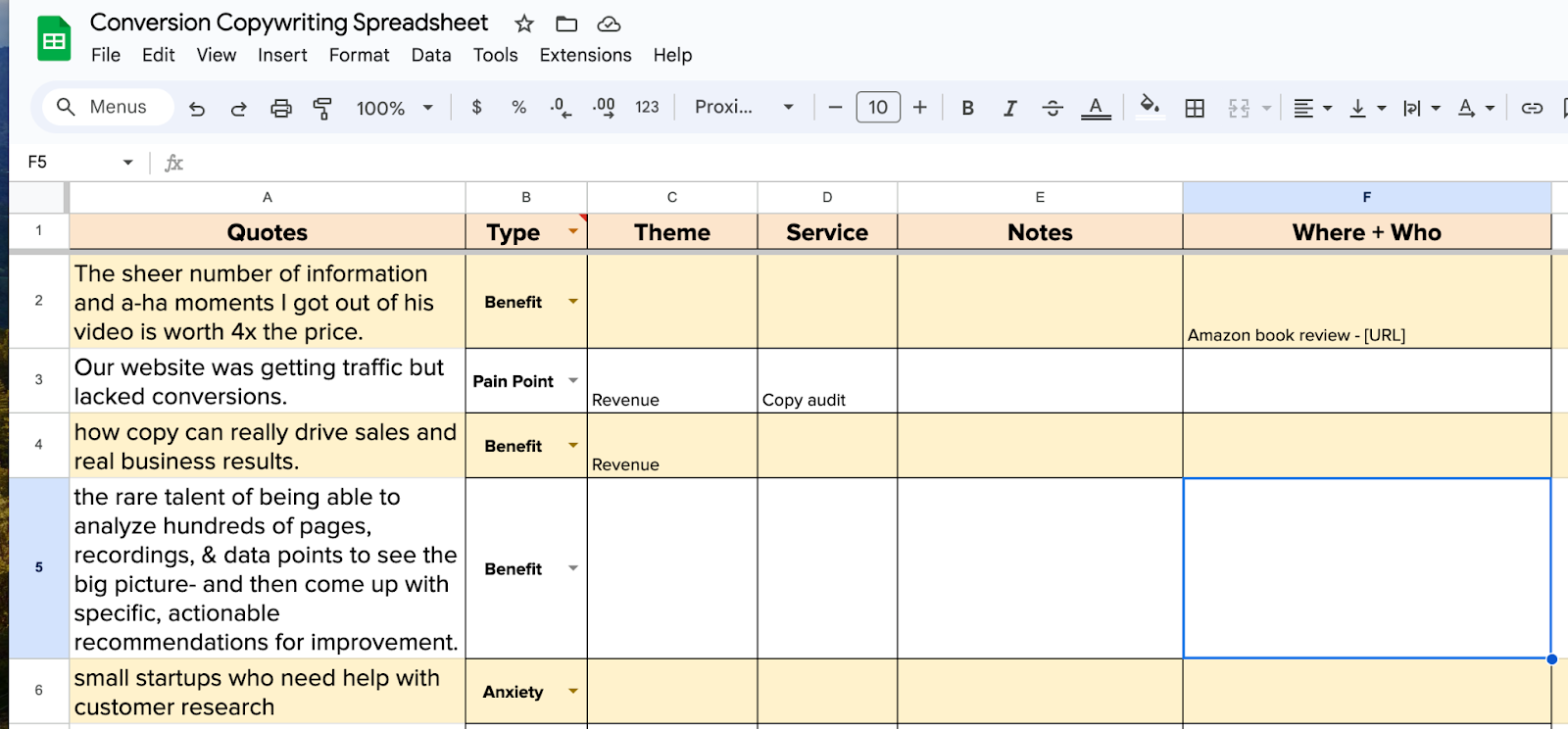

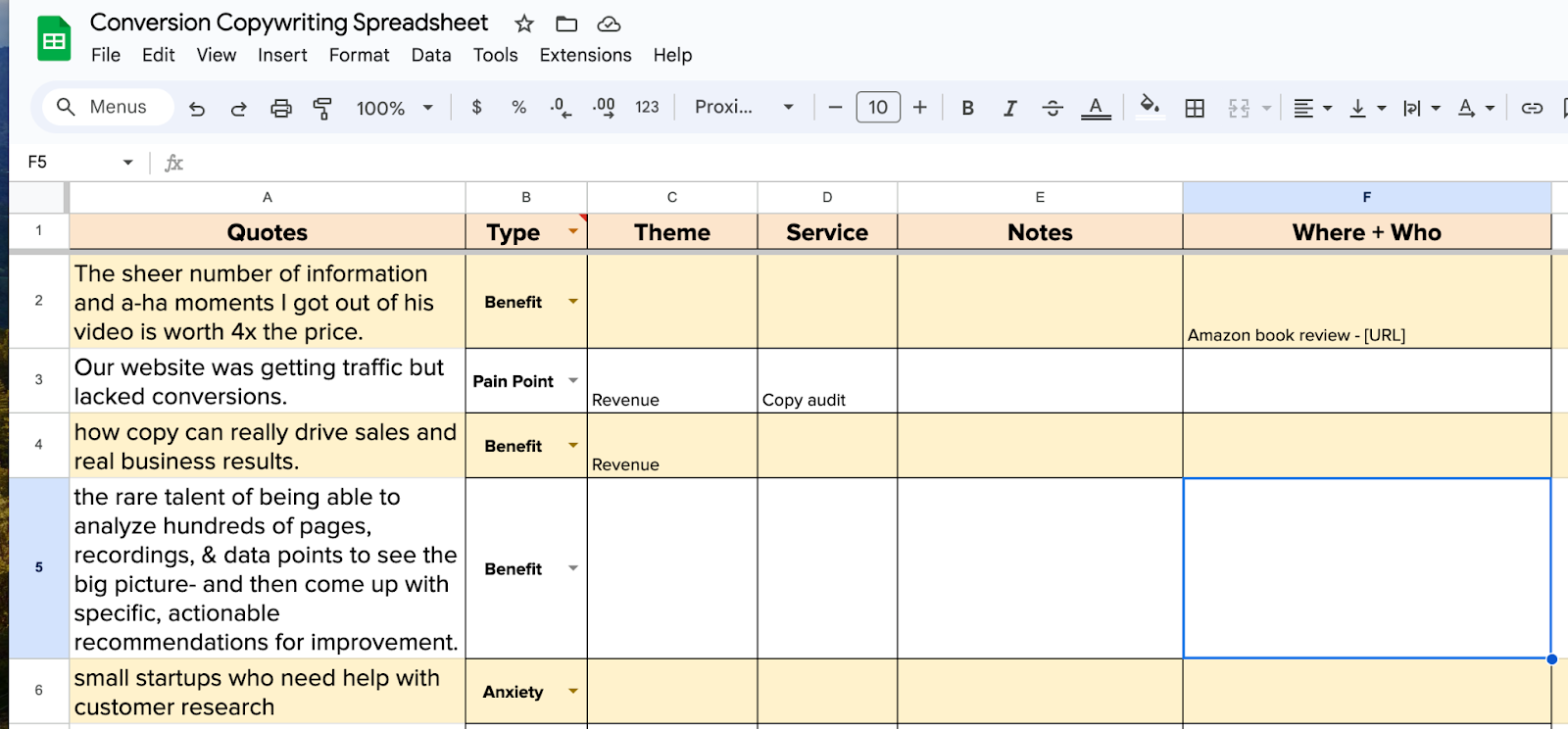

I have a sheet I use to map all of this (which you can get access to be dropping your email below).

What I look for when researching users is…

- The problem they face

- The pain point as they feel it

- The anxiety they feel around the issue

- The benefit they want to get by paying for a solution

- Any interesting language they use to describe these things

What I’m essentially looking for is what I refer to as the customer beginning, middle, and end.

The beginning is the problem they face.

The middle is the straw that broke the camel’s back, or moment of highest tension (MOHT) that forced them to look for a solution, and how they looked for the solution.

The end is the transformation they want to experience.

Your offer should be positioned as the catalyst that addresses the frustration at the MOHT and enables the end transformation. All of your research is to figure out how to do this well.

Honestly, this kind of research alone is invaluable. A day or two of this and you’ll have a much better idea of what people want and how to talk to them about it.

If you then spend the time to reduce this to the most common talking points, desires, and pain points, you’ve got the start of a really powerful messaging and positioning to help you craft marketing materials that actually drive revenue.

By this point, I had some great information on general weight loss and the problems/benefit people experienced.

I also knew a good deal about how they viewed the competition. But, you can never know too much.

Step 4 – Competitive analysis

Knowing the end user is great, but we also want to know about the competitors in the space.

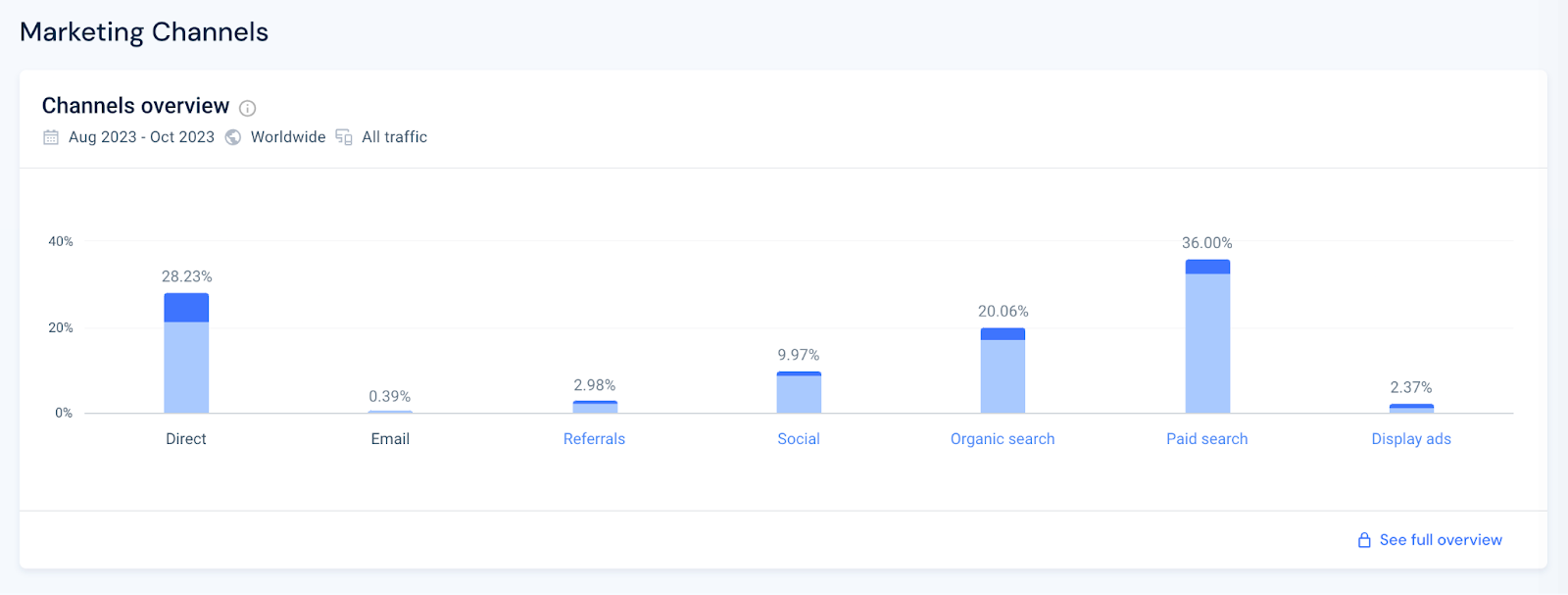

We want to know which channels they’re using and how they’re using them. We want to understand their positioning.

We want to bolster the research we’ve already done with how people view their offers.

From here, I’d spend time going through each competitor’s digital presence. I’d look specifically at…

- Their website

- Their messaging/positioning

- The articles they were creating

- Where they were getting traffic from

- Who’s mentioning them online and how

- The social accounts and their advertising habits

After that, I’d sign up to their offers and run through their process as a customer would.

Having a base level of understanding from the audience research makes it a hell of a lot easier to spot the shortcomings of the offers when you’re doing this, and it’s honestly surprising how easy it can be to spot issues you can do better.

I’d then draw up a simple page for the primary competitors listing everything I found as a quick reference sheet.

From here, I’d add on thoughts about how I thought it could be beat.

Step 5 – Analysis of research

At this point, you end up with a huge amount of information on your ideal customers and the competitors you’re going up against.

What you have to do now is look through all of this for the most common traits.

The more something appears, the more important it is for you to consider in implementing.

For example, some of the things I noticed in researching for this client…

- Almost all of the competitors relied heavily on FB ads

- Users were fed up of “yo-yo dieting”

- Most users bounced from offer to offer and rarely saw long-term progress

That alone is enough for us to come up with some basic ideas.

For example, if they were the only trends we noticed we could hypothesise that…

- Positioning around yo-yo dieting and ending it for good would work well

- Targeting users who liked the competition on Facebook ads would be an easy way for us to hoover up disgruntled users

These aren’t exactly what we did. But they were definitely part of the consideration and approaches we actually used.

I spent a good few days going through all the research to find the most commonly occurring themes and actions.

It’s then simply a case of finding the overlap between what people want, what they can’t get from the competitors, and what they can get from you.

That overlap is often where the highest growth potential is.

It’s something your users want that you offer, and that they can’t (or at least believe they can’t) get anywhere else.

Once I had a few ideas, we got working on the actual assets.

Step 6 – Positioning and messaging

The first thing we did was nail down the positioning and messaging.

This is super important and is often overlooked by brands because it’s hard. You’ll also find that too many people overcomplicate this.

Which is easy to do, as it’s super complex.

But, there’s a little cheat method I use.

The secret is to get granular with your approach to differentiation.

On the surface, you’re looking for the overlap like the image above. Basically what your users want that your competition doesn’t offer.

Simple, right?

But, you’ve also got to have a specific ICP in mind to really get the best chance of getting this right.

Take Levels Health as an example and imagine the client I was working with has a similar sensor.

Both are sensors to help people eat healthier, right.

So, you could just target the whole CGM niche and explain you help people to “Better understand what you eat”, right?

One target market with 2 potential offers.

This is what a lot of brands do when “positioning”. They focus on the macro and, because that macro is part of an even wider selection (in this case wearable sensors) they think they’ve niched down.

But we can do better.

In understanding the audience you can find a better messaging and position to help you stand out.

If you take a look at Levels site, they have a lot of imagery of people working out or talking about how they’re mapping their body’s reaction to exercise.

It’s a common thread with the Levels users that more serious athletes tend to use it.

If I were hired by Levels, I would lean into it. Create messaging, pages, and ads targeted at serious athletes who want to “shave XX minutes off their marathon time” or “get in winning shape for that competition” type thing.

This kind of imagery and messaging might be offputting to middle-aged stay-at-home parents who just want to lose a little weight to feel more confident in their body.

These people need a different message that supports them in the problems they face.

The actual service is very similar, it’s just how you present and position it to appeal to a different audience.

You can usually drill down to different use cases within the same product and find a way to differentiate yourself.

Niching down is not just about looking at the macro segment, but also the micro segments and use cases within.

You need this to find your beachhead market.

You won’t have to stay targeting that specific market forever. But it can work well to get traction and act as a beachhead market for you.

This is what I did with the client.

I decided that we couldn’t go after the more established Levels audience, and so went to an audience who felt that Levels wasn’t built for them.

This helped us devise a position that would be different from Levels and the others in the space.

We essentially could make users feel like we were built specifically for their needs and goals. Which then helps further refine the whole strategy.

Step 7 – Devising the growth model

Knowing who the audience we were targeting was and how we were going to stand out, it’s time for us to build out a potential model.

I used the ACCER model I talk about a lot when devising a growth strategy for this.

A short recap of it is that you have to have a good asset at the following stages, and then make sure they’re linked together as a coherent model.

- Attract – How you’re getting in front of people and getting them to your website

- Capture – How you’re capturing their contact details for ongoing marketing and nurture

- Convert – How you’re getting them to convert to your main offer

- Engage – How you’re getting them to continually use and find value in your offer

- Refer – How you’re getting them to refer their friends to the offer

If you’ve done all of your research you should know enough to create a compelling model.

- You should know which channel your ideal users use and so you can reach them through

- You should know what they want so can create a compelling reason for them to sign up

- You should know how they feel underserved and so can create an offer they want to try

- You should know the kind of transformation they’re hoping to achieve and so can build an engagement sequence that helps them hit their goal

- You should know what incentive will get them to share about you, and what channel you should ask them to share on

In this case, we decided to remove the Refer element from the model. We only needed a small number of beta testers and wanted to keep things relatively quiet.

Having everyone who enters the funnel speak about us on social – especially when the app wasn’t open to the public – could have proved problematic.

We saved setting anything up here for when the app was live and open to everyone.

What we did was build a very simple model that used everything we’d discovered up to this point.

I’ll break it down for you below in order of the way a user would experience it.

However, know that we built this in a different way. We started with the landing page for the ads and the email nurture sequence and qualification.

We then added the ads to kick the whole system off.

You should always build this way. Otherwise you have ads that point to nothing.

This way, you start with the system and finish by driving traffic to a complete model

How the model looked

Here’s a quick explanation of the overall model and how it looked.

It’s a really simple funnel that was basically…

- Attract – Social ads on Facebook and Insta

- Capture – Simple email capture for more info on beta

- Convert – Questionnaire to apply for beta

- Engage – Email sequences based on qualification

Here’s what we organised for each.

Step 1 – Social ads strategy

We were pretty confident in the positioning and the audience, but it never hurts to test things.

We basically used a 3×3 system for the social ads to test 2 different variables.

- The audience

- The message

This allowed us to find which messaging was most impactful for which audience quickly.

Once a week the ad specialist would do a report on what’s working and to what extent. From there, we’d identify the lowest performers and see what we could do to improve them.

That would kick off some amendments and another week of testing before we did it again.

Thanks to the initial research around the audience and competition, we actually did really well with the ads off the bat.

This is a great way to run ads as you can test things quickly and make meaningful changes.

A lot of brands I’ve seen and worked with make small changes. They see an ad not working and change something like the headline.

Small changes lead to small results most of the time.

If it’s not working you might need to tweak something larger like the audience or come up with a completely new angle.

The 3X3 approach allows you to make those big changes without compromising the effectiveness of what’s working now. You can remain flexible without affecting the winning ads.

And when those ads stop winning, you should have some backups that are picking up the slack while you make changes.

These ads lead to a specifically built landing page.

Step 2 – Landing page strategy

We didn’t do anything wild with the landing page.

I used a tried and tested landing page template that I’ve used for dozens of offers over the years, you can actually get your hands on the template by signing up below.

What we wanted to do with it was make sure that our positioning and the key offer was clear within the first few seconds the user would land on the page.

We also had to be clear that there was a disclaimer that they could apply for the beta and that this wasn’t fully ready right now.

The overarching framework of the landing page was…

- Hero section

- Explaining how it helps, what it is, and why they should choose us

- Image of the app

- Opt-in email capture

- Focus on the problem and dive into why existing services aren’t helping them

- Also talk about what it;s costing them to not solve the problem

- Introduce the solution by talking about big picture goal

- Run through features

- I like to use a “benefit + objection removal” for the feature sections

- FInal CTA

- Explain how easy it is to sign up and what they get

Really simple approach that’s worked time and time again.

I will say you can’t just wing this. The only reason this template works is because I know the audience and what they want/are struggling with.

If you haven’t done that research, it’s hard to create a page that hits.

Step 3 – Qualification

Once someone had entered their email to find out more, we had to find out whether or not they were a good fit for the beta.

With this being a health-related offer, we couldn’t just send this out to everyone.

We had to identify the best fits within the leads we’d captured. After speaking to the founder, we decided on a few things.

- We needed a good cross-section of users across age groups and genders

- We could not serve those with certain health issues

Obviously, an email capture doesn’t collect this information. All you get is a contact address.

We needed to build a simple qualification questionnaire to follow on from the email capture. Something that would ask all of the right questions to help us segment and qualify potential users.

We had one of the developers help us code a branded, custom questionnaire for this.

However, if you don’t have that a tool like Typeform or even Google Forms would work well.

We set one up that asked some key information including…

- Age

- Gender

- Location

- If they’ve tried similar offers before

- If so, which ones and their thoughts

- Do they have any health issues

- Multichoice for the conditions we couldn’t help (diabetes, heart disease etc)

- Would they be willing to offer feedback on the beta should they get in

Most questions are just to better help us understand who people are and how we can better help them.

The last few were those we wouldn’t be able to help.

I’ll explain how we didn’t waste these leads in a minute.

First want to quickly explain how we got more people to complete the questionnaire.

The primary reason we had such a huge uptake of the questionnaire is because we had positioned things well.

We were targeting an underserved and fed-up market that had a painful problem. And we had the solution.

But that’s not enough for me.

We also built a simple welcome email sequence that really hyped up the benefit of joining the beta.

It was a simple sequence we created.

- Email 1 – A simple welcome and thanks

- Email 2 – More about the company and offer (heavily focused on why this was so groundbreaking and what it could help them achieve)

- Email 3 – Absolving them of blame by explaining why other solutions often fail – and positioning us to change that

- Email 4 – FAQs which are quite promotional of the new offer

All of these would then link to the questionnaire.

As soon as someone completed the questionnaire, they were removed from the sequence and added into the next sequence depending on their results.

Step 4 – Engagement

Once they’ve filled in the questionnaire, we can make a better decision on what to do with the lead.

We generally broke them down into 3 different categories based on their questionnaire feedback.

- A fit for the beta

- Not a fit for the beta, but a fit for other products the pharma company owned

- Not a fit for the beta or for the other products

In the case of group 1, it was a simple next step.

Group 1 – A fit for the beta

They’d get put into a waitlist which the product team could pull from when they let more people into the beta.

In the meantime, they’d get a few emails explaining this and then the weekly newsletter of developments.

Group 2 – A fit for other products

These people had a health condition which meant this product would not be a fit. However, another product from the pharma company could help them.

What we’d do is send an email sequence which explained that this wasn’t a good product for them. However, there were other potentials that could help.

We’d then link them off to their other products and let those growth models take over that lead.

Group 3 – Not a fit

These are the people who we couldn’t help right now.

They’d get a simple email sequence explaining that we couldn’t help them and why.

We’d send some links to other useful information to remain helpful.

In all of the above cases, they would be added into the email list for ongoing newsletters and product updates.

The reason we decided not to scrub the lists of the users who were not a fit for the primary product was because one day it might be able to help them.

For example, the company had a specific offer for diabetics that was a better fit.

We would direct them there.

But that doesn’t mean that, when the product went public release, they couldn’t benefit from this as a general metabolism tracker.

The same thing with those who were not a fit.

They weren’t a fit for the beta, but that doesn’t mean they wouldn’t find benefit when it went out for public release.

So, we decided to keep the users on the list for future reference and potentially future conversions.

Again, each one had a simple email sequence set up to both…

- Inform them of next steps

- Help them out with useful information

Step 5 – Implementation

Once everything was in place we just had to run things up and get them actually working.

We’d convene twice per week.

One would be myself and individual team members to talk about how things are going, feedback from them, their ideas of how to improve things.

The second would be a group meeting where we made sure everyone was on the same page, was aware of progress and we could confirm the next steps we’d discussed individually.

Usually, this resulted in weekly tweaks to the various elements ot ensure we got the best results.

Results

In terms of results, this was a resounding success, especially considering we didn’t have anything close to a brand reputation on launch.

This offer didn’t use the name of the parent pharma brand nor did we leverage any existing brand equity or partnerships.

Within round 2 months of this being actioned, we had…

- 10,988 leads

- 7165 qualified leads

- CPA of $3.12

All of this started with what was, essentially, a Growth Audit of the biggest competitors.

If you want to see if you can get a plan from auditing the competition, check out our growth audits or book a free strategy session to see if we can help.